Be heard. Experience the difference of a personal, small practice with the resources of a large firm.

CREATING A RETIREMENT INCOME STRATEGY TOGETHER

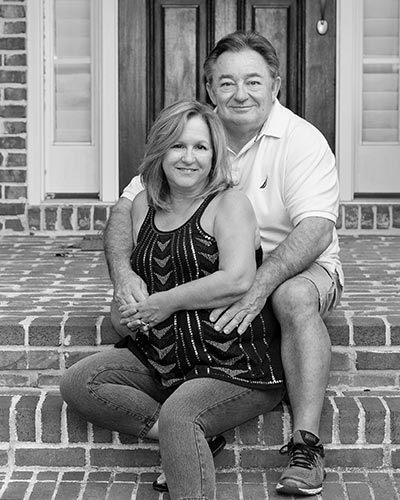

BOB & DAWN GRIMARD

Bob and Dawn Grimard have been working with clients for over 17 years providing detailed and customized services. In these challenging times we aim to create an awareness of solutions for retirees and pre-retirees for their estate and overall financial plans. We work with local CPA’s and Attorneys to help maximize the estate value and provide positive options for consideration through seminars and individual attention. Our programs help people to be more confident about their retirement savings strategies. With our help, clients can make better educated decisions to achieve financial goals. At Grimard Financial Group, you can expect professional treatment for all of your needs.

Bob and Dawn Grimard have been working with clients for over 17 years providing detailed and customized services. In these challenging times we aim to create an awareness of solutions for retirees and pre-retirees for their estate and overall financial plans. We work with local CPA’s and Attorneys to help maximize the estate value and provide positive options for consideration through seminars and individual attention. Our programs help people to be more confident about their retirement savings strategies. With our help, clients can make better educated decisions to achieve financial goals. At Grimard Financial Group, you can expect professional treatment for all of your needs.

OUR GOALS

- Show you how to use life insurance and annuity products to generate retirement income and leave a legacy for your heirs

- Show you how you may receive tax free income using life insurance

- Show you ways to pay for long-term care without buying a traditional long term care policy

- Show you ways to protect a portion of your money from a volatile stock market

- Educate you on ways to you maximize your Social Security Benefits

- Show you ways to protect your assets from probate and unnecessary taxes

- Show you how insurance and annuity products can offer you opportunities to grow your funds without losses due to the market

Income-tax-free distributions are achieved by withdrawing to the cost basis (premiums paid), then using policy loans. Loans and withdrawals may generate an income tax liability, reduce available cash value, and reduce the death benefit, or cause the policy to lapse. This assumes the policy qualifies as life insurance and is not a modified endowment contract.

Annuity withdrawals are subject to ordinary income taxes, and if taken before age 59-1/2, to an additional 10% federal penalty.

Some policies offer additional benefits and riders for long-term care needs and other expenses. These often come at an additional cost for these benefits.

Life Insurance and annuities involve fees and charges, including surrender charges for early withdrawals. Carefully review all information about the product, its costs, terms, and limitations before making a purchasing decision.

What People Are Saying

How Can We Help You Today?

CALL

Office: (603) 261-3736

Bob's Direct: (603) 809-2698

Amanda's Direct: (978) 252-4525

Toll Free: (866) 582-9373

VISIT

25 Chatfield Drive

Litchfield, NH 03052

VISITS BY APPOINTMENT ONLY

CONNECT

bob@grimardfinancial.com

dawn@grimardfinancial.com

amanda@grimardfinancial.com

Amanda is a licensed agent with a banking and mortgage industry background and a bachelor’s degree in business finance. Amanda excels in looking at the big picture of retirement to create effective strategies by first identifying any gaps between a clients’ present state and future ideals. She thrives on positively impacting her clients’ lives and planning for their best personal and financial futures. Amanda is excited to continue the Grimard promise to prioritize client needs for future generations.

Amanda is a licensed agent with a banking and mortgage industry background and a bachelor’s degree in business finance. Amanda excels in looking at the big picture of retirement to create effective strategies by first identifying any gaps between a clients’ present state and future ideals. She thrives on positively impacting her clients’ lives and planning for their best personal and financial futures. Amanda is excited to continue the Grimard promise to prioritize client needs for future generations. In her seventeen years as a licensed agent, Dawn takes great joy in seeing her client’s retirement dreams come true. With an extensive background in business, Dawn has an understanding of the pitfalls and challenges of the retirement balancing act. Dawn and Bob generously share their financial knowledge with clients, knowing that the more information you have, the better retirement decisions you can make for yourself.

In her seventeen years as a licensed agent, Dawn takes great joy in seeing her client’s retirement dreams come true. With an extensive background in business, Dawn has an understanding of the pitfalls and challenges of the retirement balancing act. Dawn and Bob generously share their financial knowledge with clients, knowing that the more information you have, the better retirement decisions you can make for yourself. Shaun is responsible for assisting our Operations Manager, with administrative tasks and client service projects and is also a licensed agent. Along with day-to-day operations of Grimard Financial he assists with planning and marketing for educational events. After Shaun’s workday is done, he is an avid bass fisherman.

Shaun is responsible for assisting our Operations Manager, with administrative tasks and client service projects and is also a licensed agent. Along with day-to-day operations of Grimard Financial he assists with planning and marketing for educational events. After Shaun’s workday is done, he is an avid bass fisherman. With a strong background in information technology, Carol is instrumental in building operational policies and strategies that keep the organization functioning smoothly. Carol’s organizational skills and her flexibility to jump from priority to priority along with her commitment to customer service makes her an essential part of the Grimard Financial team. When Carol is not working with the Grimard Financial Family, she is a very creative and accomplished photographer.

With a strong background in information technology, Carol is instrumental in building operational policies and strategies that keep the organization functioning smoothly. Carol’s organizational skills and her flexibility to jump from priority to priority along with her commitment to customer service makes her an essential part of the Grimard Financial team. When Carol is not working with the Grimard Financial Family, she is a very creative and accomplished photographer. Diane is a customer service expert that serves the Grimard Financial family with a friendly, personal touch. She is responsible for planning and facilitating all of the client events.

Diane is a customer service expert that serves the Grimard Financial family with a friendly, personal touch. She is responsible for planning and facilitating all of the client events.