If you’re one of America’s 64 million Social Security beneficiaries, you might want to prepare yourself for a significant pay raise.

If you’re one of America’s 64 million Social Security beneficiaries, you might want to prepare yourself for a significant pay raise.

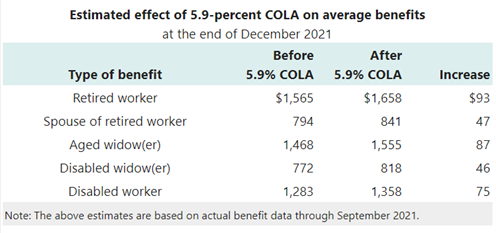

According to the Social Security Administration, the annual cost-of-living (COLA) benefits increase starts with the year you turn 62, and the COLA increase announced in October was 5.9%. Continued inflationary pressure as the economy recovers from the pandemic-induced recession means that in 2022, Social Security recipients will receive the most significant increase in benefits since 1983.

What does this mean for your retirement income?

Before getting the adjusted Social Security check, you may want to look at your monthly budget and see how you can put the extra money to use. The costs of everything from gas to food to utilities have increased, and you’ll want to earmark your extra income accordingly.

Be aware that anyone on Medicare or Medicaid will likely not feel the effects of a full 5.9% bump because of increased premiums associated with health care and Medicare Part B in particular. These payments are generally taken out of Social Security and could impact the adjustment you see.

If Social Security checks are your only income, there generally won’t be any change in taxes. However, if you’re someone who draws on other retirement savings in addition to Social Security or is working and receiving benefits, part of your checks may become taxable. Taxpayers who receive other sources of income over the threshold amounts in addition to Social Security benefits should prepare to see an increase in their tax bill.

Social Security payments, alongside other income, can impact your tax bracket during your retirement years, so diligence is required to ensure you’re keeping yourself in the lowest tax bracket possible. Call us today at (603) 261-3736, and together, we can determine any necessary changes.

Bob has a passion for making your money work hard for you. He takes profound joy in ironing out a plan for a long and comfortable retirement, no matter what your current income or level of wealth. With a work ethic second to none, he has a zeal for transforming uncertainty into stable ways for you to protect your future and your family. He knows that the quality of your life you enjoy today can remain as rewarding—or even better—after retirement.

Bob has a passion for making your money work hard for you. He takes profound joy in ironing out a plan for a long and comfortable retirement, no matter what your current income or level of wealth. With a work ethic second to none, he has a zeal for transforming uncertainty into stable ways for you to protect your future and your family. He knows that the quality of your life you enjoy today can remain as rewarding—or even better—after retirement. With a strong background in information technology, Carol is instrumental in building operational policies and strategies that keep the organization functioning smoothly. Carol’s organizational skills and her flexibility to jump from priority to priority along with her commitment to customer service makes her an essential part of the Grimard Financial team. When Carol is not working with the Grimard Financial Family, she is a very creative and accomplished photographer.

With a strong background in information technology, Carol is instrumental in building operational policies and strategies that keep the organization functioning smoothly. Carol’s organizational skills and her flexibility to jump from priority to priority along with her commitment to customer service makes her an essential part of the Grimard Financial team. When Carol is not working with the Grimard Financial Family, she is a very creative and accomplished photographer.